© 2023 DOPE CFO

Ready To Be A World Class 280e Accounting Professional?

Experienced accountants, bookkeepers and tax professionals are needed in a BIG way to service companies subject to 280e in this rapidly growing niche. If you're ready to get started, click below.

GET STARTED

Before we dive into all the details...

We’d like for you to take a moment to imagine...

- Take yourself out of your current situation as an accounting professional, and imagine a scenario where you aren’t being told what you are worth as a professional (by your boss, employer, clients, colleagues, etc).

- Where you aren’t being undercut because “someone else can do it cheaper.”

- Where you’re able to choose your clients and who you work with, versus taking what you can get.

- Where you’re working with clients and projects that are challenging, yet exciting because you are able to attribute how your work creates value in their business.

- Where you’re known to be highly knowledgeable in one of the fastest growing industries in the country.

The choice is yours, and that choice looks like becoming a DOPE CFO ACCOUNTING PROFESSIONAL.

The Proper Accounting Team for a Company Subject To 280e In The "GREEN Industry" Must:

- Understand the various entity types within the industry, and their specific needs (grow/farms, extract/processors, product manufacturers, distribution, dispensary/retail, labs, and delivery).

- Understand how to properly do GAAP accrual and cost absorption accounting.

- Have the right tools, systems, and workpapers to do proper bookkeeping and accrual accounting, as well as accurate reporting for both IRS and state compliance. This will also help CEOs and investors have insight on the financial health of their company.

- Understand how to prepare the proper monthly reports so that their clients are always AUDIT, LENDER, BOARD, AND INVESTOR READY.

- Understand special tax issues including 280e, 471, 263a, 199a, and other applicable court cases.

What if we told you... that if you were ready… DOPE CFO can help you launch your own national accounting firm specialized in 280e TODAY!

AND you will confidently be able to provide WORLD-CLASS SERVICE, and WOW your CEO clients every month!

You see, the reality is that of the approximately 100,000 legally licensed businesses subject to 280e in the US, the majority of them have inexperienced and untrained bookkeepers that simply don’t have the knowledge, tools, or workpapers, and are unable to do the complex cost and accrual accounting required.

Untrained bookkeepers also don’t understand how to navigate 280e, 471, or other tax rules, which is dangerous in such an audit prone industry, leaving these businesses open to huge fines and penalties. This will leave LOTS of money on the table for these companies.

So if you’re ready and you’ve decided...

✔ YES to working in this rapidly growing and massively underserved industry.

✔ YES to becoming a specialist in a niche that desperately needs your passion, expertise, and commitment to WORLD-CLASS SERVICE.

✔ YES to working with other like-minded professionals so that you can learn, share knowledge and wins, and stay on top of this fast-paced, highly regulated industry.

GET STARTED

Our DOPE CFO Accounting & Tax 4.0 Program is for seasoned accounting professionals (bookkeepers, tax professionals, Controllers, CFOs, CPAs, etc) who are looking to build a fully remote, national accounting and tax practice specializing in this exciting industry, or to add the expertise and services to their existing business.

The goal of the program is to give you the education, marketing system, tools and workpapers, and premier community of experts that you need in order to get up and running quickly, which includes:

Our Easy 4-part Marketing System for Landing Great Clients!

We provide this proven system in the 280e Accounting & Tax 4.0 Program that details how we prospect QUALIFIED business owners, and land clients that pay us thousands every month for our services. We bill on the value we provide and never cost per hour.

Our Proven Process For Closing New Business

Even if you hate sales, and marketing isn’t your skill set, don’t worry. If you follow our proven system, which includes our cold outreach emails, call scripts (we never “sell;” we just ask questions on our call), our pricing checklist and Excel price quoting tool, and our offer templates, you will have what you need in order to help you land YOUR FIRST 280e client.

We Understand The Pain Of CEOs In This Niche...

So our messaging is specifically crafted in such a way that you attract the clients that will benefit most from your help and support.

Once you land a new client, we give you every system, process, tool, and workpaper that you will need in order to provide WORLD-CLASS SERVICE to their business, and WOW them with your expertise, even if you do not have an accounting degree. These systems are ready to go on day one. Just plug and play, and there is nothing missing.

Our program has templates, tools, and workpapers that were developed by licensed CPAs with over 20 years of experience. Many of these documents have been reviewed by attorneys and tax experts specialized in this industry, and have been used to provide services to complex businesses (and of course companies subject to 280e) of all shapes and sizes.

Most important, they are specifically tailored to the various entity types. These documents and templates include:

EXCEL CHART OF ACCOUNTS (READY TO GO FOR QUICKBOOKS, XERO, AND OTHER SYSTEMS)

SPECIFIC to grows/farms, processors, distribution, manufacturers, dispensaries, and complex entities.

Note: Quickbooks and other common systems DO NOT have charts of accounts specific to this niche.

COMPLETE MONTH-END TIE OUT SYSTEM

Highly detailed template file with reconciliations and “tie-outs” of every balance sheet and P&L account, which are tied from source documents to:

- Accounting records

- Trial balance and reconciliations

- Final consolidated financials

These Month-End Tools and Workpapers help ensure your client is consistently AUDIT READY, with both a Permanent Audit Trail and a Perpetual Data Room available for auditors, lenders, investors, acquirers, partners, and tax preparers, any time and all the time.

COST ACCOUNTING WORKPAPERS TAILORED TO THIS NICHE

Our charts of accounts are tailored to the needs of various entities including grow, processor, product manufacture, distribution, lab, and dispensary so that you can easily do correct cost accounting each month. We provide detailed instructions, examples, videos, templates, and actual workpapers to acquire the operating data needed each month in order to perform correct cost accounting.

While you are providing TONS of value making sure your client’s accounting practices are following IRS and state license rules, the value that you are providing to the CEO is EXTREMELY important.

On top of all this...

We provide client “Value-Add” documents that give your client so much more and will really separate you from the pack.

With these documents, you will be empowering CEOs with critical information that will help them better understand how to make educated decisions about their business. You will be able to show them how these systems, tools, and processes can sizably increase the value of their company… so that your fees can be seen as an investment in the company.

These documents (and video and written instructions) include:

- Consolidated financials

- Rolling cash forecast

- Capital Raise Financial Models

- Start-Up Tools and Pitch Deck Tools

- Cash control tools for dispensaries

- Internal control and corporate governance docs

- CEO specific dashboards and scorecards

- ...and so much more!

Who should sign up for the DOPE CFO Accounting & Tax Program?

This program is NOT FOR...

- People who are not interested in working with businesses subject to 280e

- Accounting professionals who want us to do the work for them

- Professionals not looking to build their clientele

- Accountants who know everything, and aren’t willing to collaborate and learn new methods and standards of operating their firms

- People who want to take shortcuts and are not committed to providing WORLD CLASS SERVICE. The program is an end-to-end solution that gives CEOs the deliverables and insights that are REQUIRED and that they NEED in order to properly run their business

- People who are just looking for another job opportunity and are fine being told what they are worth by an employer

- People who are looking to get rich quick

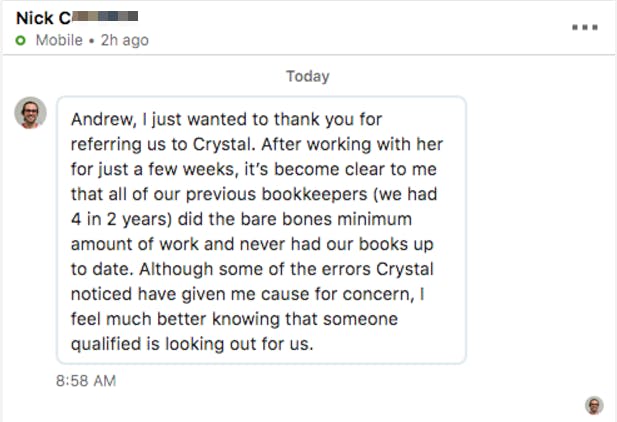

CEOs LOVE DOPE CFO REFERRALS ❤️

You have to understand one thing about CEOs in this niche:

The stakes are incredibly high. There are many financial challenges that these CEOs must overcome in order to be successful.

With state and federal compliance rules making such a booming industry produce razor thin profits, you could be the missing piece that will allow CEOs and investors to protect their licensure and grow their investments.

THE DOPE CFO ACCOUNTING & TAX PROGRAM VALUE

The DOPE CFO Accounting & Tax Program provides every single process, document, tool, workpaper, and template (over 120 actually) needed to serve your clients on day one, as well as hundreds of hours of video instruction specific to accounting and tax knowledge in this industry, and education that we and our student members use every day in our successful practices.

✔ PROVEN 4-PART MARKETING (NON-SALESY) SYSTEM

This system provides templates and the EXACT steps that you need to take in order to land your first client. Our materials are tailored specifically to accountants who hate sales and marketing. From emails, to no-pitch call scripts, to offer letters (including a price quoting tool), you will have everything you need in order to consistently bring in new business month over month without having a huge marketing budget.

✔ V.I.P. SYSTEM TO BECOMING A VALUABLE PROFESSIONAL EXPERT, INSTRUCTOR, AND PARTICIPANT

Become exclusive:

- Valuable Professional Expert - in ALL things related to this industry and the clients you serve

- Instruct - Clients, Prospects, Events, Podcasts, Webinars, Articles

- Participate - Get Involved in the movement!

Once you become a V.I.P. it’s like applying the secret sauce… and when you do it right, you will be the ONLY logical go-to accounting resource clients will find you and you will serve them better, meaning HIGHER FEES.

✔ PROPRIETARY ONBOARDING & MONTH-END CLOSE SYSTEMS

These files have been created over many years and are the “meat” of the course. This includes our Onboarding documents that will allow you to onboard your new client including an engagement letter template, PBC (“Prepared by Client”) List, an action plan template, a file management system (so that you can stay organized), and a detailed process to help get your client up and running as quickly as possible. They also include all of our templates for building a summary of Accounting Policies & Procedures, as well as Internal Controls Documents for each of your clients.

✔ CHART OF ACCOUNTS AND ALL COST ACCOUNTING WORKPAPERS

These workpapers have been created, modified, and updated with input from many specialized tax CPAs over the last few years and create a set of workpaper templates and processes to enable you to do correct GAAP/tax cost accounting each month (which is required to minimize tax for your CEO client).

✔ PERPETUAL DATA ROOM

These files and structures enable clients to have a Perpetual Data Room that is audit, lender, investor, management ready any time/all the time. This PDR will also make your accounting work easier and more efficient, saving you time and money!

✔ DISPENSARY/FARM/PROCESSOR CASH ROLLING FORECAST AND CASH CONTROL WORKPAPERS

Most businesses in this industry are cash-based, which can be problematic. We provide the tools that are necessary in order to help them find a 280e-friendly banking option if one exists in their state, and/or advise them as to how to best manage cash most efficiently as well as cash forecasting tools and financial models.

✔ CULTIVATION WIP, GROW CALENDAR, AND YIELD WORKPAPERS

These are “must-have” documents that build on data in the “field” and track strains, yields, cycles, % complete and other essential data to be able to do correct cost accounting.

✔ INDUSTRY SPECIFIC KNOWLEDGE, LINKS, CASES, AND TAX SUMMARIES

We provide workpapers that will make your clients “tax ready,” and thorough documentation on how to navigate 280e, 471, GAAP cost accounting, and various other tax rules. We provide the latest tax research and court cases related to the industry, as well as exact information on 280e/471 and cost accounting required by the IRS to minimize taxes.

✔ INTERNAL CONTROL AND CORPORATE GOVERNANCE WORKPAPERS

Includes all of our templates for building a summary of Accounting Policies & Procedures, as well as Internal Controls & Corporate Governance for each of your clients.

✔ OVER 100 OTHER FILES, WORKPAPERS, AND DOCUMENTS

As a BONUS, we’ve included the following value adds:

⇒ BONUS ONE: You will receive a 30-day free membership to DOPE CFO VIP COMMUNITY, our Premier Private community of CPAs, CFOs, Bookkeepers, EAs, and MBAs, where you can network with peers (who are also in the program), have ANY questions answered, learn more daily, and build your team. Plus, you may have the opportunity to share and/or refer clients to each other!

⇒ BONUS TWO: As part of DOPE CFO VIP COMMUNITY, you will receive 30-days free access to our bi-weekly Q&A calls. These 60-minutes calls are led by DOPE CFO Founder Andrew Hunzicker and cover real course topics and answer ALL your questions!

⇒ BONUS THREE: You will be able to upgrade into our premier “DOPE CFO VIP COACHING & BADGE NETWORK” Program after only 90 days in the program. This program includes live coaching in accounting, tax, marketing, and more, as well as additional tools and workpapers, a DOPE CFO VIP Digital Badge, listing on our private DOPE CFO VIP Badge webpage, where real business owners can find you and your website, drawings to be on the DOPE CFO podcast, a live prospect call with Andrew, and MUCH MORE!

GET STARTED

Our Freshness Guarantee

We always do everything in our power in order to make sure that you have the latest and greatest information, as well as updated templates and workpapers so that you can continue to properly service your clients.

PRO-TIP:

Leverage members of our DOPE CFO VIP Community to create partnerships and build your team, so that you have everything that you need to fully service your client’s accounting needs. (Ex. If you are a CFO that needs a bookkeeper and a tax preparer to help service your clients, tap into the group of professionals in order to fill those roles for your accounting practice).

So now you need to ask yourself…

"Do you want to go into another tax season with the same story, long hours, more stress, and impatient clients… all while making the same or less money (unless of course you find more clients)?"

Or do you want to get in on an industry that is in desperate need of your help and expertise?

If you enroll in our DOPE CFO VIP Community today, you will receive instant access to:

- Our 3-Part System: Become a VIP, Find Great Clients, and World Class Client Service that will get your specialized accounting and tax practice up and running, and you can start connecting with CEOs on day one.

- Over 125 ready to go, customizable, tools, templates, workpapers, and instructions that will help you navigate the specific accounting needs of businesses subject to 280e.

- Our no-pitch sales script that you will use when you talk to prospects, where you will only ask questions about their business. When you are part of the premier national DOPE CFO Program, you’ll never have a need to defend your resume or spend time talking about how much you know (or don’t know). We simply ask questions, then let them know we will send over a proposal showing how we work, the value we provide, and the investment they make in us as service providers. No need to ever “sell” your services!

- Our WORLD CLASS CLIENT SERVICE process, powered by our Onboarding, Cleanup, Day to Day, Month-End Processes, Cost Accounting, Robust Reporting Package, and client Value-Add documents that will help CEOs confidently navigate and make decisions based on accurate and up to date company financials.

BONUSES INCLUDE:

- 30 days of access to our DOPE CFO VIP COMMUNITY MEMBERSHIP, powered by Andrew Hunzicker, CPA (your program facilitator), and others who have completed the program and are successfully working in this industry. This community offers peer support so that you can offer a FULL SUITE OF ACCOUNTING SERVICES to your clients (and outsource to the network parts you do not want). This also includes Bi-Weekly Q&A calls and Live Office Hours with Andrew.

- Ability to upgrade into our premier DOPE CFO VIP COACHING & BADGE PROGRAM after only 90 days with live calls with marketing, tax, and accounting experts so you can build your firm with confidence. Premier Digital Badge, Private Web Listing and much more!

- Accounting and tax court case summaries that you can reference.

- Consistent updates on new tax rules, new places to find CEOS, new states where it is legal, and information as it becomes available surrounding the industry.

- Potential referrals from 280e clients!

Course Details

LEVEL

Intermediate/Advanced (For experienced bookkeepers, Enrolled Agents, CFOS, & Accountants/CPAs)

SETTING

Hybrid (Online/Virtual) + 30 Days of LIVE Community Interaction, Lessons, and Q&A

COURSE LENGTH

You can use these materials forever, but it’s designed so you can jump in on day one and land your first high paying client within 90 days (note results vary and are related to the effort you put into the program!). The education/training component can be completed in 90 days in under 30 minutes a day, but, even if you have a client on day one, our program is built to be “plug & play,” so you can easily jump ahead to the World Class Client Service Module. And why not jump into Module 2: Find Great Clients on day one and spend 10 minutes to find and email your CEO prospect? Jump back and forth as needed! The program is user friendly whether you need knowledge/information, or a new client, or a tool in the toolbox. Nothing is left out for you to build a successful firm.

GET STARTED

How it Works...

A simple email or a phone call from a professional like you, that has the resources and can create the results that come from a program like ours, is what this industry needs. We are providing the EXACT SYSTEM that we, and others that have successfully completed our program, have used to:

- Get new clients & onboard them successfully

- Provide monthly accounting so clients can stay in compliance with the states & IRS

- Create a Permanent Audit Trail via our Month End System, including correct cost accounting workpapers

- Provide robust reporting packages that include much more than the basic financial statements

- Provide monthly “value-add” documents to all your clients

- …and so much more.

Complete the steps within the program to land your first client

Onboard your first client with our World Class Client Service System

Deliver WORLD-CLASS SERVICE to your client using the systems, tools, processes, and workpapers we've outlined in the program

Who Should Join...

CFOs

CPAs and Accountants

Bookkeepers

Enrolled Agents

Tax Preparers

Why you should join...

Because you’re excited and see the HUGE potential in becoming a DOPE CFO ACCOUNTING PROFESSIONAL.

Because this program is a fast-tracked education and support system that could take YEARS and TENS OF THOUSANDS OF DOLLARS to obtain otherwise.

Most important, it will make you a better service provider to your clients in general…

How?

Because our program makes it easy for you to communicate the value of your work to CEOs and Owners.

You'll be providing them deliverables and insights that can save your clients money, and help them make better decisions.

And, you’ll be able to command more money for the great work that you do (and feel great about it)!

So if you want to become an expert in this RAPIDLY GROWING and MASSIVELY UNDERSERVED niche, provide WORLD CLASS SERVICE to your clients, and make more money while doing so… this program is for you.

GET STARTED

Then, you’re ready to take the first step in becoming a DOPE CFO ACCOUNTING PROFESSIONAL.

This program is for...

- People who want to GROW their accounting practice without having to spend a fortune on fancy marketing campaigns

- Accounting professionals who are PASSIONATE about what they do, but hate the long hours, low pay, and the fact that CEOs don’t understand their value

- Bookkeepers and accountants that are sick of negotiating higher rates with clients that don’t want to pay

- Professionals who are ready to WORK REMOTE and PAPERLESS with their clients

- Those that are sick of long hours and having to sacrifice time with family in order to do what they love

- People who are ready and willing to do the work, and make the effort to dive feet first in this industry, knowing how important their role is in helping companies subject to 280e and other strict legislation related to this industry