It's not a question of if these highly regulated companies will be subjected to an audit, but when.

In a highly regulated and federally illegal market, companies subject to 280E of all sizes and verticals are under severe scrutiny at both federal and state levels. Accountants & bookkeepers are tasked with the big jobs of accurately managing the day-to-day transactions and monthly reporting to keep a company compliant and ready at all times to survive any audit.

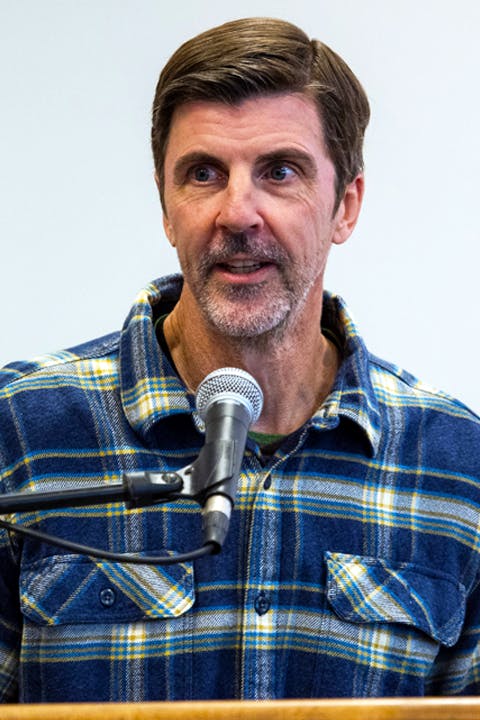

Join DOPE CFO founder Andrew Hunzicker for our in-house webinar, “The Ultimate Bookkeeping Guide.” A great bookkeeper is an invaluable asset to any growing company in this "Green Rush". Whether you’re a bookkeeper, accountant, or CEO, this webinar will show you what bookkeeping practices must be in place to build a foundation from the day-to-day transactions to buggy software workarounds. If you’re looking for THE guide on bookkeeping for companies subject to 280E, this is it!

About DOPE CFO

We are the first nationally recognized "Green" accounting & tax program.

DOPE CFO offers the most comprehensive and top notch accounting & tax training program for professionals who want to serve companies subject to 280E. Because there is little to no GAAP guidance yet (the Big Four are currently not involved in the industry), you will be hard pressed to find reliable accounting and tax guidelines online or through the AICPA. Through our program, you will correctly learn each aspect that is necessary to provide World Class Service to "Green" businesses, the plug and play tools and workpapers to serve them easily on day one, and the unique requirements to keep them compliant.

With more than 1,000+ members in our VIP program, we have a built-in community of experienced professionals. We are your one-stop shop to gain the resources, network, and expertise required to succeed in this amazing industry.

#bedope

Your Webinar Host

Andrew Hunzicker, CPA

DOPE CFO - Founder

Register to View:

The Ultimate Bookkeeping Guide For 280E Companies

In a highly regulated and federally illegal market, companies subject to 280E of all sizes and verticals are under severe scrutiny at both federal and state levels. Accountants & bookkeepers are tasked with accurately managing the day-to-day transactions and monthly reporting to keep a company compliant and ready at all times to survive any audit.

There’s a way to NOT propel those companies into a downward spiral of damaging fines and shutting down within a year or two of opening. That way is for bookkeepers, accountants, and CEOs to get on the same page by understanding that specialized bookkeepers can step up and help 280E companies get compliant - fast.

Essential aspects of bookkeeping for clients in the "Green Industry" that we'll cover include:

- Why an internal bookkeeper is not enough

- Various tax codes and court cases

- A to Z cleanup and onboarding within the first 30 days

- Day-to-day and month-end accounting processes

- And more!

*“GREEN” business & the “Green” industry: we’re talking about companies that are subject to 280E and IRC Sec. 471. (Sometimes the internet gods get upset when we use the exact words here on the page for reasons we can’t understand). It’s the only industry where new states are going recreational every day and nationwide changes are coming soon.

THIS SITE IS NOT A PART OF THE FACEBOOK WEBSITE OR FACEBOOK INC. ADDITIONALLY, THIS SITE IS NOT ENDORSED BY FACEBOOK IN ANY WAY. FACEBOOK™ IS A TRADEMARK OF FACEBOOK, INC.

Dope CFO - All Rights Reserved - Privacy Policy - Terms of Service